With the start of a new year, we find it necessary to recap the investment policies in China for investor's information and evaluation of their business plans relating to China operations. Overall, there have been many changes to the rules in connection with foreign invested enterprises ("FIEs") in China in recent years and most of such changes are very positive to investors, simplifying and streamlining the processes for foreign investment and reducing the related costs.

1. Applicable Laws

With the effectiveness of Foreign Investment Law of the PRC from January 1, 2020, the previous PRC WFOE Law, EJV Law and CJV Law have all been replaced or abolished. In May 2020, China legislation body also promulgated the long-awaited PRC Civil Code, which consolidates and replaces many earlier civil laws of China such as the Contract Law of the PRC. In December 2020, the Ministry of Commerce and National Development Reform Commission jointly issued the Measures for the Security Review of Foreign Investment, regulating the national security review with respect to foreign investment in China.

For purpose of your general reference, here are the major laws and regulations applicable to foreign investments in China under the current rules:

· Foreign Investment Law of the PRC (2020)

· Civil Code of the PRC (2020)

· Company Law of the PRC (2018 Amendment)

· Partnership Enterprise Law of the PRC (2006)

· Labor Contract Law of the PRC (2012 Amendment)

· Measures for the Reporting of Foreign Investment Information (2019)

· Measures for the Security Review of Foreign Investment (2019)

· Regulations of the PRC on the Administration of Import and Export of Technologies (2020 Revision)

· Regulations of the PRC on the Administration of Foreign Exchange (1997 Amendment)

· Regulation of the PRC on the Administration of the Entry and Exit of Foreign Nationals (2013)

· Special Administrative Measures (Negative List) for the Access of Foreign Investment (2020)

· Provisions on the Administration of Registration of Foreign-funded Partnership Enterprises (2019 Revision)

It should be noted that the above is only a list of high-level laws and regulations relating to foreign investment and operation in China. When it comes to specific issues, it will be necessary to do a comprehensive search of the related laws, regulations and rules relevant to the specific matter, industry, and city etc.

2. General Requirements

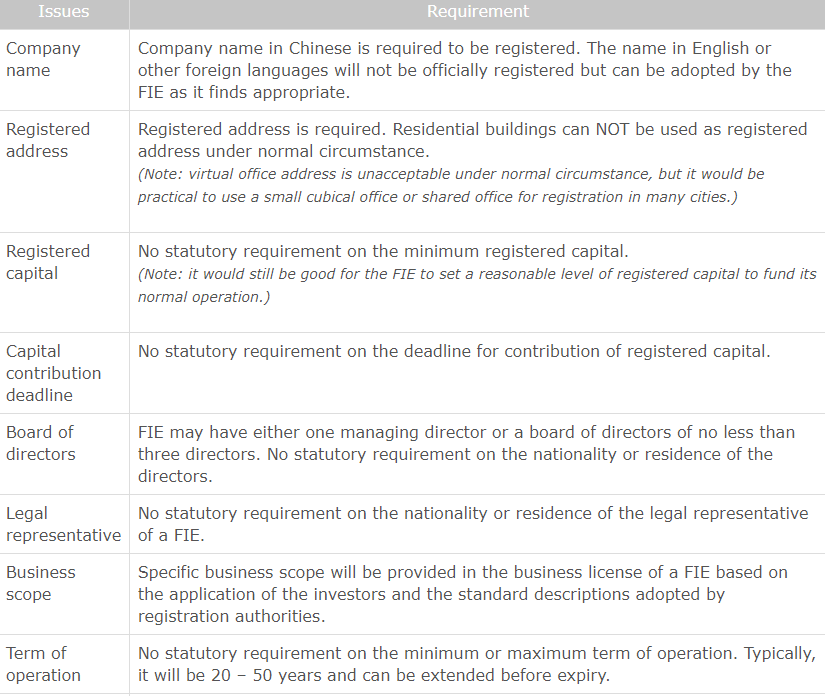

While there may be a lot to be discussed about the requirements for company establishment and operations in China, we hope the following table may help you have a general sense of the main requirements with respect to company registrations in China (applicable to both foreign invested enterprises and domestic companies):

3. Investment Procedure

With the effectiveness of Foreign Investment Law of the PRC from January 1, 2020, the foreign investment approval from Ministry of Commerce and its local branches is no longer required. Furthermore, many registrations previously required to be made with various authorities have been consolidated or removed in recent years. As a result, the registration with local Administration of Market Regulation – AMR (formerly known as AIC) has become the only application to be completed for the establishment and subsequent operations of FIEs (as well as domestic enterprises) under most circumstances, except for some few special industries where approval from the regulatory authority in charge of that industry may be required e.g. banking, securities. AMR shall review the investment application by checking against the applicable Negative List for the Access of Foreign Investment to see if the investment falls within prohibited or restricted area for foreign investment. Under the 2020 Negative List, only 33 items are still listed as prohibited or restricted for foreign investment, which means it is unnecessary for a foreign investor to worry about the Negative List in most cases.

As a result of the government administrative reforms in the past several years, there have been a great simplification in application requirements and reduction in processing time with respect to the establishment and registration of companies in China. Besides, the foreign investment approval has been removed for most of the investment projects. Accordingly, the average total time for setting up a FIE (foreign invested enterprise, including WFOE and JV) in China has been reduced from 1 – 2 months in the past to only 2 – 3 weeks at present (excluding the opening of bank accounts).

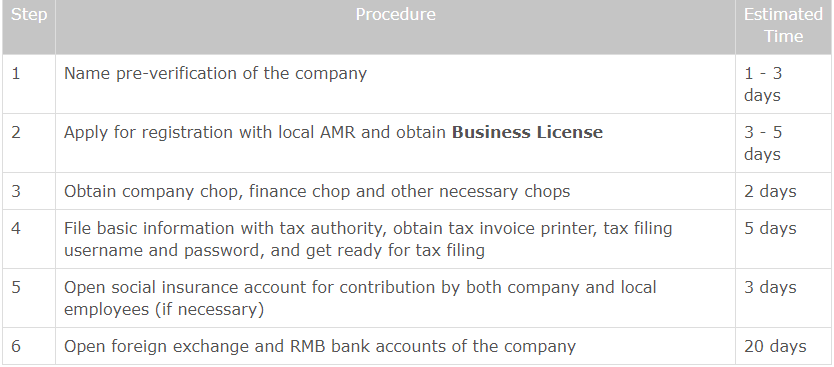

Below is a brief outline of the steps currently required for setting up a FIE in service sectors e.g. consultancy company or trading company:

Notes:

- Manufacturing enterprises and companies in some other special industries will take longer time than the above estimate, as they may require environmental assessment or approval from other industry regulatory authority.

- The above estimated time has not included the time for preparing the application documents as well as the notarization and legalization of the investor’s certificate, which may take about 1 – 2 months or even longer subject to the client’s internal processing speed.

- Although the registration efficiency has been greatly improved, the documents must strictly meet the requirements of the AMR. To avoid rejection or re-execution of the documents, it is strongly advised that such documents be prepared by experienced professionals.

4. Foreign Exchange

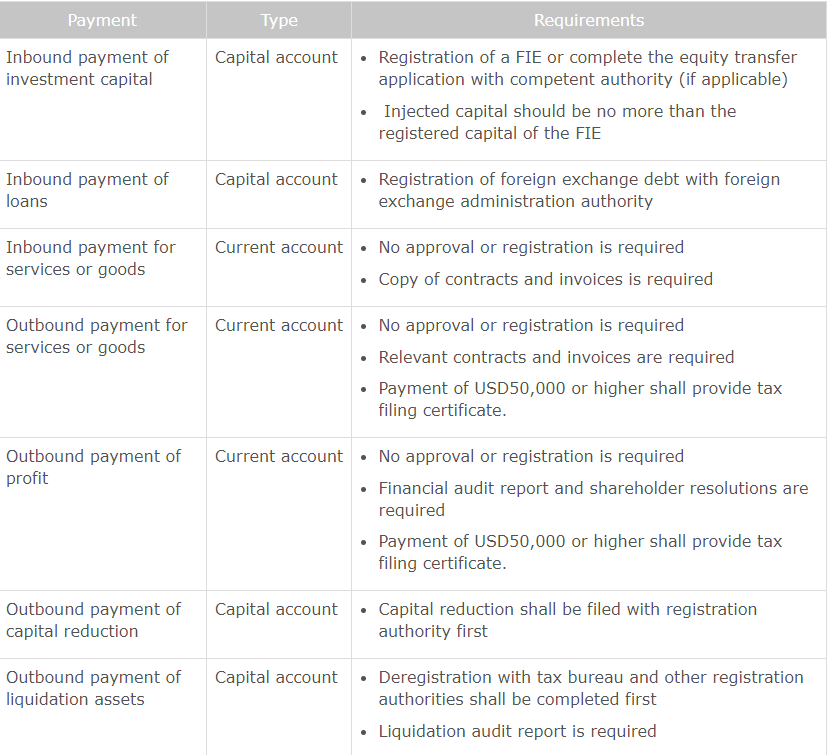

Rules relating to foreign exchange including inbound and outbound remittance of foreign exchange and the conversion between foreign exchange and RMB basically remain the same. In general, the following principles will be adopted by foreign exchange authority / banks in China for transactions and payments involving foreign exchange:

- Any foreign exchange payment to China must have a specific purpose declared to banks in China and shall be classified as either a capital account item or a current account item.

- Inbound payment of investment capital or foreign exchange loans is regarded as a capital account item which must be preceded by appropriate government registrations before such payment can be accepted by banks in China. For example, the prerequisite for a capital injection into a FIE is that the FIE has been registered with Business License issued by competent registration authority and the capital injected to the FIE is within the limit of the registered capital of the FIE.

- Inbound payment for services or goods is regarded as a current account item and will be accepted by banks after the submission of the contracts and invoices in respect of the payments without the need to complete any registration or government application.

- Conversion of investment capital of foreign exchange into RMB should be conducted on an authentic-purpose basis which should be consistent with the scope of business of the FIE, and shall not be used in investment of securities or real estate (unless specially approved). Declaration forms should be submitted to banks to state the purpose for the conversion of the foreign exchange capital. If the amount of conversion is higher than USD50,000, supporting documents relating to the use of the fund such as contracts and invoices will be required.

- Outbound payment for services or goods will be processed by banks after the submission of the contracts and invoices in respect of the payments. However, if an outbound payment for service is USD50,000 or more, a tax filing certificate in respect of the payment shall be submitted to the bank. In other words, the FIE must first withhold and pay the applicable taxes relating to the outbound service payment or obtain the tax exemption certificate (if applicable) before such payment is be remitted out of China. Outbound payments for goods can be processed based on corresponding import documents for the goods.

- Outbound remittance of profit is a current account item and not required to be approved by the government, but should be completed by submitting requisite audited financial reports, tax filing certificates and shareholder resolutions in order to be processed by the banks.

- Outbound payment of reduced investment capital is a capital account item which must be preceded by appropriate government registrations before such payment can be processed by banks in China. Specifically, a FIE shall complete the filing of capital reduction with the competent registration authorities. In practice, reduction of capital is relatively rare and could run into some problems due to a lack of more detailed official guidance on how to complete such process.

- Outbound payment of liquidated assets is a capital account item which must be preceded by appropriate government registrations before such application can be accepted by banks in China. Specifically, a FIE shall complete the deregistration with all the competent registration authorities including tax bureau, AMR, foreign exchange bureau, customs, etc. A liquidation audit report will also be required for the repatriation of capital back to investors. That said, applications for liquidation and deregistration are very common with clear official requirements on the procedures and documents. As long as a FIE has properly completed the deregistration applications and settle all pending taxes, there are no obstacles for repatriating all the remaining fund back to investors after the liquidation.

Please find below a brief summary of the different types of foreign exchange payments and requirements for your easy reference:

5. Taxation

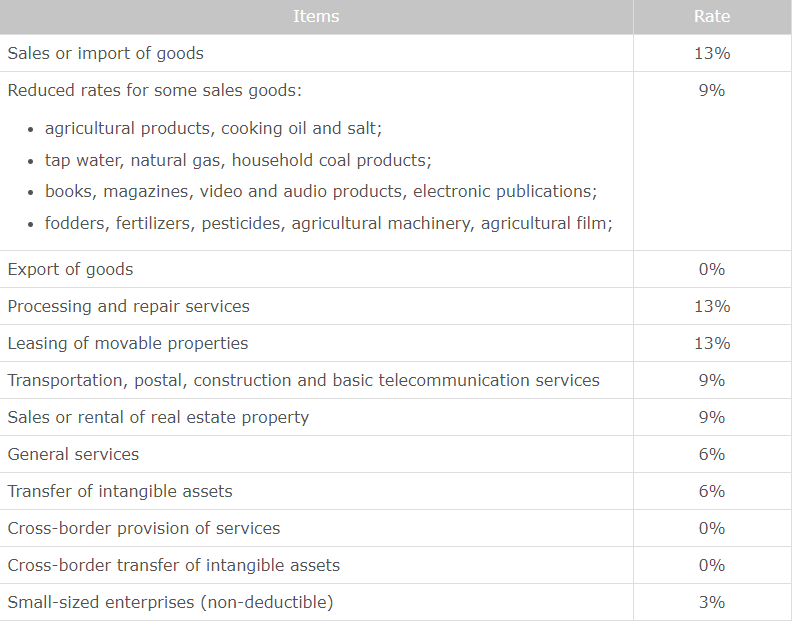

Since May 2018, there has been significant reduction in the VAT rate for manufacturing industries as well as sales/import/export activities in China, with standard rate reduced from the previous 17% to the current 13%. Provision of services were previously subject to business tax, but has been gradually changed to be subject to VAT since 2015 with a standard VAT rate of 6%. The government has also offered many tax incentives for small enterprises in recent years.

In general, the following main taxes are applicable to FIEs under the current PRC tax rules:

- Value added tax (VAT): imposed on the revenue from sales of goods, processing and repair, provisions of services, with standard rate of 13% for sales of goods and 6% for most services while some industries are subject to other VAT rates. Small-sized enterprises are subject to VAT rate of only 3%, but will not be allowed to deduct input VAT against sales VAT.

Below is a detailed list of VAT rates applicable to various taxable situations:

- Enterprise Income Tax (EIT): imposed on the net profit from the business operation of an enterprise. The standard EIT rate is 25%, and 15% for high tech enterprises and enterprises registered in special areas. In recent years, the government has offered many incentives to small-sized companies including reducing the cost for EIT, with effective EIT rate reduced to only 5%.

- Individual Income Tax (IIT): imposed on comprehensive income, mainly the salary and other remunerations received by employees based on progressive tax rates ranging from 3% to 45%. IIT is not taxed on employers, but rather on the employees, however, in China employers are obligated to withhold and pay IIT for the remunerations paid to employees. Failure to file and pay IIT for employees will subject employers to tax surcharges and penalties.

- Other taxes

There are some other taxes which may be relatively less significant or less likely encountered, such as:

- Consumption tax

- Stamp duty

- Urban Real Estate Tax

- Education Surcharge

- Urban Construction and Maintenance Tax

6. Annual Filing

Under current rules, all enterprises includes FIEs are required to complete an annual filing with the Administration of Market Regulation (AMR) through its online system – National Enterprise Credit Information Publicity System before June 30 each year. Information to be reported in the annual filing normally include:

- Company address, telephone number, email address;

- Information relating to new subsidiary or equity investment in the past year;

- Amount and time of registered capital having been contributed by shareholders;

- Information relating to equity transfer of shareholders;

- Total number of employees, total assets, revenue, profit, tax paid in the past year.

Failure to complete the annual filing before the deadline will result in the non-compliance company marked with a record of “business of abnormal status” in the publicity system which can be accessible to the general public, thus it’s vitally important to complete the filing in time to avoid affecting the compliance status. Having said that, the completion of the annual filing is relatively simple, taking only several hours under normal circumstance. Just don’t forget to make the annual filing before the deadline.

7. Employment

FIEs and domestic companies are subject to the same set of employment rules in China, with Labor Contract Law of the PRC being the foremost legal basis for regulating employment issues between employers and employees. As it’s a relatively complicated topic, we are not going to cover the details relating to employment requirements in this article. We would only caution investors that an employment contract is entirely different from a normal contract. Even if the parties have reached mutual agreement on certain matters, it could be void or unenforceable if it conflicts with the Labor Contract Law.

Below are the main legal issues important to employment matters under normal circumstance:

- Execution of employment contracts

- Term of employment

- Probation period

- Salary and bonus of employees

- Overtime pay and vacation pay

- Social insurance and housing fund

- Renewal of employment contracts

- Non-compete agreement

- Termination of employment contracts

- Severance pay

8. Liquidation & Deregistration

Liquidation and deregistration has increasingly become a commonplace matter in the operation and registration of companies in China. Sometimes, it’s due to a closure of business, but more often it may be due to a restructuring of organizations or an adjustment of investment. Compared with the past, the speed for completing deregistration processes by government authorities has been greatly accelerated in recent years due to the administrative reforms of the government which significantly simplify the procedures and requirements for company deregistration. Most notably, the tax deregistration period has been reduced from an average processing time of 4 – 6 months in the past to only 2 – 6 weeks under normal circumstances at present based on our experience in the past one or two years, because most enterprises are allowed to apply simplified deregistration procedures if they have no significant non-compliance tax filing records and can skip the complicated and time consuming tax investigation and review.

Without going into details of the deregistration requirements, below is a brief description of the general steps to be completed for completing liquidation and deregistration for a FIE in China:

Step 1: pass shareholder decision/resolution for the liquidation of the FIE

Step 2: file the name of liquidation group members and the in-charge person with the registration authority;

Step 3: make public announcement of the liquidation through newspaper or official system;

Step 4: complete the following liquidation matters:

(1) notify the creditors of the FIE;

(2) terminate employment contracts and other contracts of FIE;

(3) settle debts and collect receivables of the FIE;

(4) dispose remaining assets of the FIE;

Step 5: complete the following deregistration applications:

(1) deregistration with the tax bureau;

(2) deregistration with the customs;

(3) deregistration with social insurance center;

(4) deregistration with the registration authority, i.e. local AMR;

(5) deregistration with foreign exchange authority;

Step 6: repatriation of remaining capital fund:

(1) engage a CPA firm to prepare and issue a liquidation audit report;

(2) tax filing and settlement for the repatriation of the capital and obtain requisite tax filing certificate;

(3) application to the bank for repatriation of remaining capital of the FIE;

(4) closure of bank account;

Note: The above procedures are based on the current practice in Beijing. There may be slight changes to the procedures from city to city.

By Jeff Sun, Huatian Law on January 13, 2021